The price of a single bitcoin stands at around $11,000 (£8,000) as I write this. But within minutes this could have risen or fallen by a huge margin. Exciting stuff isn’t it?

The rise of this ‘digital gold’ is currently on the tongues of every financial commentator and investment portfolio manager, and you’ll hear wildly differing views on its future, depending on who you listen to.

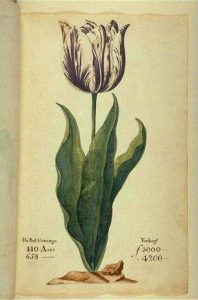

The most common analogy from the doomsayers warning against investing in bitcoin or cryptocurrencies in general is the great ‘tulip mania’ bubble of the 1600s.

Then, prices for Dutch tulip bulbs – particularly rare varieties – soared in value on the back of what appeared to be pure speculation, ie those who were paying ever higher prices for the bulbs purely in the hope of selling them on to people prepared to pay more.

At the peak of the ‘mania’, some bulbs were selling for several times the salary of an average skilled Dutch worker. However, the petals fell off in 1637 when bulb prices collapsed and many ‘investors’ who still held positions lost their perceived fortunes virtually overnight.

On the flip side, there are those who believe Bitcoin has got a long way to go in terms of price. Some are convinced its value will double by the end of 2018, while a handful of – quite respectable – commentators have speculated that it could go a lot higher. And when I say a lot, I’m talking about the moon – $1million per coin.

So, if after reading the above you’re still interested in dipping your toe in the cryptocurrency market, you’ll be please to know that you don’t need to stump up eleven grand to get in on the action.

You can start your bitcoin portfolio with almost any amount of money because each coin is actually made up of 100,000,000 Satoshi (named after the alleged, verging on mythical, inventor of the coin – Satoshi Nakamoto). Again, at the time of writing, $1 will buy you around 9,000 Satoshis (excluding any transaction fee that an exchange may levy).

The fact that bitcoin is actually just a series of 0s and 1s across a network known as the blockchain means that it’s easily divisible unlike, say, a physical bar of gold. There are also dozens of places where you can buy bitcoin, each offering varying degrees of complexity.

We’re going to shamelessly plug the Coinbase exchange here as we’ve found it an extremely easy way to buy bitcoin (along with ethereum and litecoin), with reasonable fees. You can buy cryptocurrency with either a debit or credit card and the coins will be in your digital wallet within seconds.

It’s also one of the biggest exchanges in the world which should held erode any nagging worries you may have about security following a series of high-profile exchange hacks over recent years.

If you use this link to sign up to Coinbase and buy or sell $100 or more of cryptocurrency you’ll receive $10 worth of free bitcoins. Not bad huh!

All those zeros can get confusing, especially given the rapidly fluctuating price of bitcoin, so keep an online bitcoin value calculator to hand when you’re ready to make your first purchase. The price changes second by second so make sure you know exactly how much you can afford to spend and potentially lose if things go pear-shaped.

The same principle of division also applies to other cryptocurrencies as well, with coins such as bitcoin cash, dash, ethereum and litecoin all broken down into fractions available for purchase.

Once you understand that you can dabble without having to make a serious financial commitment you’ll soon break through the psychological barrier and realise that buying bitcoin is as easy as any other online purchase.

And if you don’t fancy spending your hard-earned cash on coins you can always gather some Satoshis for free from what are known as bitcoin faucets.

These are websites that reward you with tiny amounts of coin in return for your visit. They do this because they earn advertising revenue based on the traffic they get and the clicks on their ads. The more traffic, the more money they earn so they incentivise you to keep returning and claim your free coins.

Two popular faucets are freebitco.in and cointiply.

You can read our full guide to free bitcoin faucets here, then head over to our best free bitcoin faucets or faucet list pages and start earning your first coins without any outlay on your behalf, apart from your time.

As a footnote, what could help bitcoin become even more mainstream in the future would be some form of price stability, but that is unlikely to happen during this current period of wild speculation by individuals, together with financial institutions who now have access to a bitcoin futures market.

Nor will it happen without greater regulation and state control. While this may be the antithesis of why bitcoin was set up in the first place, it could be good news for the future of the currency, particularly in a cryptocurrency market that is becoming ever more crowded.

NOTE: This article does not constitute investment advice. The value of investments can go down as well as up. Past performance is not a reliable indicator of future outcomes.

Other pages you might like: